tesla tax credit 2021 colorado

The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. This means that any cars sold by GM and Tesla after May 24 2021.

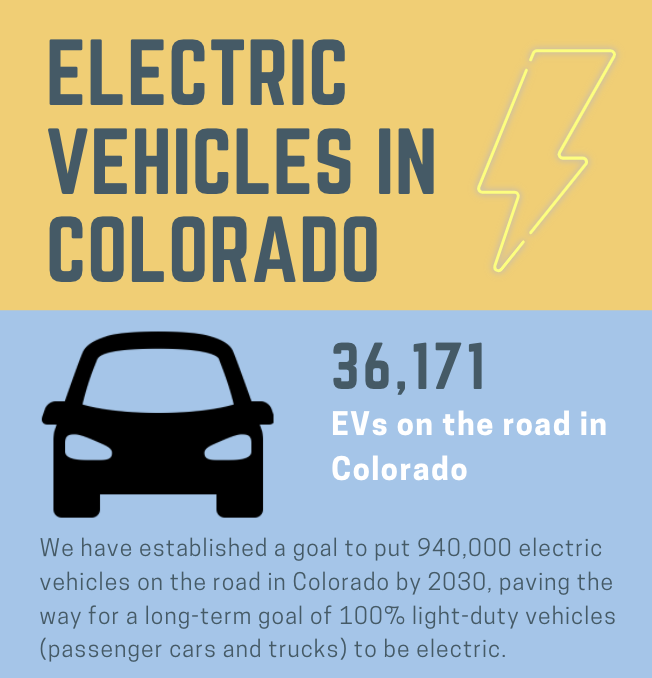

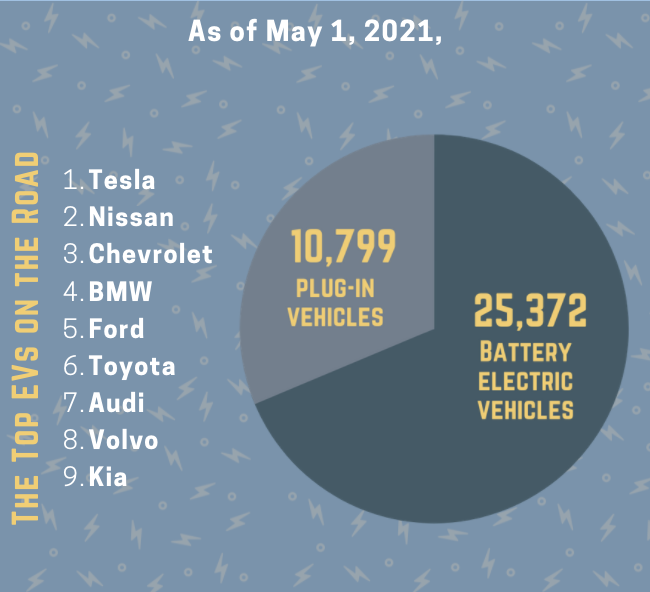

Electric Vehicles In Colorado Report May 2021

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

. Colorado Likely to Extend 6000 Plug-In Vehicle Tax Credit to 2021. 2022 Tesla Model 3. So weve got 5500 off.

Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. At up to 6000. Colorados alternative-fuel vehicle tax credit is one of the most lucrative in the nation.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. The dates above reflect the extension. Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year.

The main one is that it caps the 7500 tax credit to 200000 electric vehicles per manufacturer. Some dealers offer this at point of sale. The incentive amount is equivalent to a percentage of the eligible costs.

2022 Tesla Model 3 RWD 19 46490 1200. When combined the 26 federal solar. Tax credits are as follows for vehicles purchased.

Contact the Colorado Department of Revenue at 3032387378. This puts automakers who were early proponents of electric vehicles like Tesla. 112017 112020 112021 112023 but prior to.

If you lease an electric vehicle for two years beginning from 2021-2023 you can get a 2000 tax credit. However the standard tax credit of 7500 applies retroactively to any Tesla car purchased after May 24 2021 and before January 1 2022. This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax credit.

Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. You could also be eligible for a tax. However unlike the Historic Property Preservation Credit detailed above this newer credit 39-22-5145 CRS is not dependent upon the growth in general fund revenues and will continue.

This cap is eliminated retroactively for vehicles sold after May 24 2021 Chairmans Mark p. Beginning on January 1 2021. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

2022 Tesla Model 3 RWD 18 44990 1200. I wonder if there will. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

Credit Amounts for Vehicles Leased by Transportation Network Companies Tax year beginning on or after. Oct 29 2021. That includes Teslas Powerwall.

Colorado offers a tax credit of up to 4000 for purchasing a new ev and 2000 for leasing one. With the 55k for sedans limit it looks like the M3LR will be 40k credit and the Performance will be 58k no credit. The credits decrease every few years.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. You can claim the Colorado Electric Vehicle Tax Credit for yourself on. Chances are youve heard of the.

Federal tax credits of up to 7500 are still available for most EVs. Tesla tax credit 2021 north carolina.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek

Tesla Recalls 54 000 Cars And Suvs Over Rolling Stop Feature For Stop Signs

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicles In Colorado Report May 2021

New 2021 Tesla Model 3 Performance For Sale In Colorado Springs Co 5yj3e1ec4mf995655

Tesla Sees 1st Ever Annual Profit But Misses Estimates Daily Sabah

Colorado Solar Incentives Colorado Solar Rebates Tax Credits